7 Strategies for Growth

Eva

on

September 13, 2022

- NetSuite

7 Strategies for Growth

It’s been 60 years since U.S. business leaders have had the chance to ride a 6% GDP expansion. Grabbing more than your share of new business requires innovative pricing, supply chain and customer acquisition actions. Our 7 strategic pillars range from fulfill inventory anywhere to making metric-driven decisions and capturing new revenue streams.

By Art Wittmann

We are in the midst of the biggest single-year economic expansion since the 1960s. That’s the consensus from the International Monetary Fund, various U.S. government agencies, the Federal Reserve and most leading economists. The Conference Board predicts 6% U.S. GDP growth for 2021 after a 3.5% decline in 2020, and the Bureau of Labor Statistics confirms that, in the first quarter of 2021, the country topped that 6% annualized figure.

With almost no institutional memory of those halcyon days of the 1960s remaining in C-suites, however, optimizing for success is uncharted territory for business leaders. Capitalizing on this opportunity will come down to planning, positioning and a careful reading of — and quick reaction to — incoming data.

To drive thinking about how to capitalize on the boom now underway, we’ve identified seven areas that warrant strategic consideration. We’ll discuss each briefly here, with links to some deeper dives, and continue to provide best practices as the year progresses.

As with any forecast, that 6% projection from The Conference Board comes with risk factors — both downside and upside. Keeping these in mind will help temper expectations and shape your own best practices.

Of all of these, the only risk that business leaders directly control is a productivity boost driven by digitalization. We will therefore recommend best practices for technology use throughout our discussion. Still, upside risks are more likely than downside, with the exception of unstable worldwide supply chains. In other words, if you aren’t already, treat this boom as fact, not forecast.

It’s time to move fast and make money.

- Chapter 1

- Chapter 2

- Chapter 3

- Chapter 4

- Chapter 5

- Chapter 6

- Chapter 7

Supply Chain Responsiveness

Many supply chains will remain unsettled through 2021, and some of the biggest, most sophisticated global manufacturers are affected. It’s been headline news that most automakers are slowing production because they can’t get the microchips they need. In the worst cases, some manufacturers will produce only half of their capacity in the coming months.

And yet, at least one Japanese automaker says its production won’t be affected because it has a four-month supply of these critical components on hand.

Clairvoyance, a fluke or exceptionally good luck?

None of the above, actually. These critical parts come from only a few foundries in Hong Kong and Taiwan, and this automaker understands the threats endemic to that region. It also calculated that the carrying costs of a four-month supply of chips isn’t all that high. So it stocked up, just in case.

The company didn’t take the same approach with other components, ranging from glass and leather to the myriad subassemblies that go into cars. It had multiple sources for these materials, and the risk of those supplies failing to appear on time was low.

Granted, that simplified explanation belies the intense statistical analysis that carmakers apply to their supply chains. But it is a useful anecdote to illustrate the need for differentiated supplier management.

Point is, when a necessary component is available from only a limited number of suppliers in a small geographic area, companies should carry more safety stock. That is, unless that supply chain hadn’t been substantially disrupted in decades, as was more or less the case for chips and other raw materials and finished goods coming from Pacific Rim countries.

A tanker blocking the Suez Canal. Brexit. A ransomware attack shutting down a major petroleum pipeline. Nobody would blame a supply chain manager for dismissing risks not seen in years, or ever. And if you had foreseen and presented a case to buy a few months’ worth of chips, leaders in the throes of the just-in-time craze would likely have dismissed your concerns as improbable — in which case, Scarlett Johansson or Morgan Freeman will play you in the upcoming sci-fi blockbuster about the one lone manager who knew a disaster was looming.

Action Items

- Diversify — no matter your company size: Big manufacturers know all about supply chain In our example above, Hong Kong and Taiwan are just 450 miles apart in the South China Sea. The political environment alone should be cause for significant concern. Whether you take a highly rigorous statistical approach or rely on your teams’ understanding of your supply chain, there’s a clear mandate to diversify if you can, hold more safety stock if you can’t. Geographic diversification is a first line of defense for critical supplies, and the time to develop those relationships is before there’s a crisis.

- Adopt a hybrid JIT/JIC inventory approach: An obsession with just-in-time inventory — getting components in the door just before they’re needed on the line — is both ingrained and increasingly old school. When critical items are not available from multiple suppliers in geographically diverse parts of the world, carrying a larger stock of those items — a hybridized just-in-case model — is now the norm. Of course, you need to weigh carrying costs. A few months’ supply of microchips could probably fit in the automaker CEO’s conference room. Not so with most of the components it takes to make a car. And for most companies, carrying months of inventory of anything will impact cash flow. CFOs will want to bring a careful analysis to bear, but going forward, we expect a hybrid JIC/JIT inventory management strategy to become the norm. In the real world, it’s not one or the other.

- Hone supply chain visibility and demand planning: If critical stock is an issue and carrying costs threaten margins, it’s time to The 80/20 rule states that 80% of results — sales, and more importantly, profits — come from 20% of efforts, customers or another unit of measurement, often a comparatively small set of products or services. An ABC inventory analysis exercise, where you group SKUs based on demand, cost and risk data, will typically reveal production priorities. Companies with a good grasp of unit economics tend to gain significant clarity. Hopefully, implementing systems and gathering data to better manage demand planning and supply chains, create forecasts and understand unit economics were part of your work in 2020. If not, now is the time.

Capturing New Revenue Streams

As we’ve discussed, the opportunity for substantial growth should extend into 2022, especially for businesses poised to capitalize on the opportunities that emerged in 2020. There are some challenges — disrupted supply chains, skills gaps, distribution and customer acquisition costs — we know will remain as headwinds. It’s less certain whether inflation and policies to manage it from central banks around the world will be a factor.

While the Fed increased its U.S. inflation forecast for 2021 from 1.8% in December to 2.2% in March, officials have long predicted “transitory inflation” as the economy reopens. With spiking demand for everything from rental cars to lumber, most experts don’t expect reactionary tightening of monetary policy as of now. But those March Fed numbers are way too optimistic. The U.S. Bureau of Economic Analysis says Q1 inflation clocked in at 6.4%. So unless we see some deflation in coming quarters, 2.2% for the year is a virtual impossibility.

CFOs need to chart a range of inflation scenarios and have plans in place for pricing strategy, supply chain diversification and how raising the cost of your goods and services might affect customer acquisition and retention. Standard customer churn analysis can shed light on the latter two factors.

One thing is for sure: Finance teams will have their hands full as they determine risks and margins with new revenue streams.

Action Items

- Make that “temporary” new revenue channel permanent: Many companies planned for or opened new revenue channels in 2020, and that experience is a huge It may be tempting to look at those moves as temporary. Some owners of high-end restaurants, for instance, have talked about ending their takeout programs. They don’t want to compete in that market with what they consider to be inferior versions of their products. That’s a fair point. But most businesses, like manufacturers that stood up direct-to-consumer ecommerce sites or firms that dabbled in the subscription economy, will be happy to continue nurturing new revenue streams as long as the customer experience and margins remain acceptable.

- Overcome the pricing challenge: Pricing may be one of the trickier factors to get right during the recovery, so it’s well worth adopting an analytical approach. Consumers with cash and pent-up demand don’t seem to be highly price conscious — at this point, simply being able to deliver goods and services that are in demand is a strong differentiator. At the same time, workers aren’t rushing back to jobs that both paid low wages and put them in harm’s way, whether from the virus or belligerent customers, so labor costs may rise. Want to get really serious about revamping your pricing? Consider adding a chief revenue officer to focus not just on price but on overall customer happiness and revenue optimization.

- Make scenario planning part of your DNA: Everything from unit costs to customer satisfaction will likely be in flux over the next 12 to 18 Price hikes acceptable to the market could get chewed up by increases in other areas. 2020 required fine-tuned financial analysis to survive; 2021 and 2022 will require that level of analysis to thrive. Those scenario planning skills you gained in 2020? Refine and refocus plans as the level of unevenness in the recovery becomes apparent. Didn’t get started? There are a number of templates and formalized frameworks. What’s important is choosing a method that works for your team.

Flexible Fulfillment

This past year saw a number of customer engagement trends accelerate. Ecommerce took off as consumers became comfortable shopping for more, and more types of, goods from their homes. Manufacturers learned how to sell directly to consumers, and many traditional retailers doubled down on their already effective omnichannel approaches.

In service of those new channels, marketers are pushing hard on their own new ways to attract attention, from engaging social media influencers to flooding consumers with retargeted ads. And it’s working. Those efforts are bringing in new business that helps offset losses due to restricted in-person selling. And, in many cases, those new sales are via new fulfillment channels.

This year, the challenge is keeping customers happy with fast and predictable fulfillment. Success is bound to your ability to manage inventory holistically.

Action Items

- Connect inventory, fulfillment and ecommerce: Managing customer expectations as delivery services struggle to keep up is perhaps the most challenging part of opening and maintaining new sales channels. Businesses with storefronts can fulfill many orders and ease returns using existing facilities, leading to the rise of BOPIS. But success with “buy online, pick up in store” requires centralized inventory management, ideally connected to your order fulfillment system. Further, since ecommerce often accounts for a significant share of sales, those systems should connect to the ecommerce engine so that customers can see what’s in stock and when orders will be ready. Whether or not your business has a network of stores, it’s smart to think about alternate fulfillment channels. If business is brisk and getting serious about new channels will make it more so, using third-party logistics (3PL) companies for fulfillment is a good short-term strategy — and potentially long term as well, depending on your profit margin target and current fulfillment capabilities. If your operation is geared to fulfilling orders in pallet volumes, 3PL companies can help with smaller orders.

- Beef up new ecommerce systems: In some cases, the ecommerce sites businesses stood up last year showed a fraction of available inventory or offered only rudimentary ecommerce functionality. For some, these sites were a first, quick foray into selling direct to consumers (D2C); for others, it was a way to sell unique goods, like PPE, that required a different channel than a direct sales team. Now it’s time to refine websites to offer more products, take better advantage of data for personalization programs and improve the ecommerce customer experience, including adding the ability to track shipments, estimate when orders will be fulfilled and accurately show available inventory. Success with every bit of this requires tying fulfillment management to the ecommerce site as well as tracking new order fulfillment and inventory KPIs.

- Automate fulfillment: It’s a theme we’ll return to repeatedly. Automation is the next logical step once you’ve implemented cloud-based business and fulfillment/order management systems. A primary task when automating any process is to build in your business rules so that the system handles new transactions properly, minus the inefficient, legacy processes that are likely slowing you down now. Some rules are fairly generic. Say a customer pays for two-day delivery; that order goes toward the head of the FedEx or DHL queue. Other rules may be highly specific to your business. Perhaps long-term or high-value customers get full shipments of popular products, while smaller or newer retailers may receive only partial orders. Without automation, managing complex business fulfillment rules is an error-prone and confusing matter for staff. With automation initiatives to fine-tune business rules are more likely to come off without a hitch.

Automation for Scale

Automation, like exercising and reading more, always makes the annual resolutions list but never quite bubbles to the top. 2020 likely changed that. Whether it was to better support remote work, enable scenario planning or remote closes, get serious about ecommerce, improve supply chain management or all of the above, lots of companies at least laid the groundwork for automation.

So, unlike using the treadmill that’s now draped in clothes and shame, the automation resolution is one you can and should keep.

Adding better digital systems, or finally fully using existing capabilities, helped lots companies get through 2020. Now, many are looking at taking the next steps toward eliminating the rote, slow, error-prone, human-based processes that suck the life out of staffers and leave decision- makers with incomplete or suspect data. Once digitalization happens, leaders not only get more timely and accurate insights, they have more staff resources to devote to interpreting and acting on them.

Capturing that 6% expected growth for the second half of the year requires a fresh look at automation — it can be the difference between winning new business versus ceding ground to competitors because you’re too busy reading spreadsheets.

Action Items

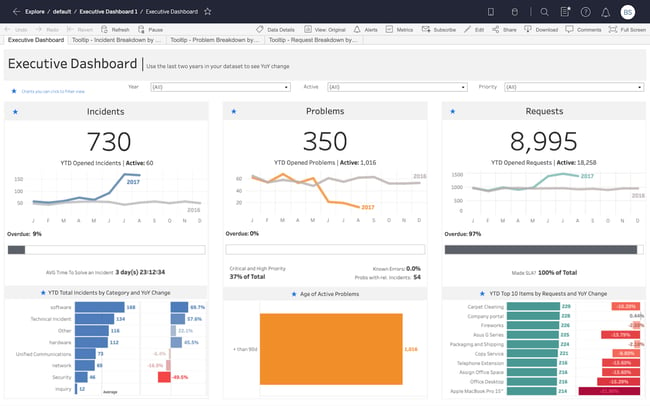

- Plan automation holistically: Automation by its nature needs to be a holistic exercise — develop a vision of your perfect system, then chip away at making it reality. Think about self-driving cars. Automating steering, acceleration and braking separately without a plan of how you’ll tie them together won’t get you a vehicle that safely drives itself. In business, operations groups want automatic visibility into activities across the company. Sales wants to acquire new customers and sell more to existing Marketing wants to understand the results of its campaigns. Production wants to automatically monitor supply chains, stock levels and output. And finally, finance wants to automate closes, AP and AR and get more timely data to improve its ability to provide financial planning and analysis for the company. But to really grow in a scalable way, sales needs to know about inventory and production. Marketing needs to know which products produce the most revenue and profit, and production needs to track sales forecasts so that it’s churning out items that are in demand. And finance needs a high-level understanding of how all these functions are performing so that it can guide the business toward growth and profit. That sort of powerful integrated business planning starts with a vision of data sharing as a means of empowering each part of the company to be better and more efficient at what it does.

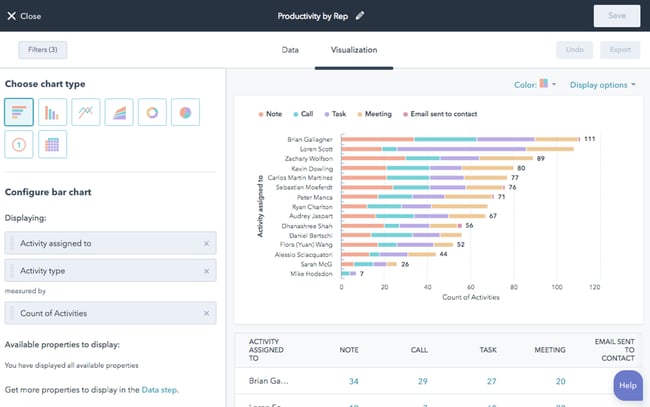

- Define processes, set business rules, repeat: As with automating fulfillment, a customer might get discounts if it maintains a $10,000-per-month spend, for example, while in another company that threshold might be $25,000. With automation, you define these rules in the applications you’re using and let the system implement them consistently and automatically. Rules can define how you recognize revenue, when you order more stock, how you set production quotas — whatever makes your company tick. What was once manual now happens according to defined policies, including requirements for approvals of various actions. Automated tasks happen faster and with fewer errors. Fraud is minimized. KPIs and dashboards are created automatically for executives, freeing up managers’ time to pay more attention to the business. In the end, you get more consistency, more timely data and more effective use of staff. All of which are needed to capitalize on current growth opportunities.

- Drive payoffs in efficiency and productivity: On average, larger businesses drive more revenue on a per-employee basis than smaller ones, and automation is a big reason With automation, marketers can manage more campaigns, sales teams can deal with more customers and finance teams need fewer resources to close the books. This efficiency accrues with time, so it can be difficult — though not impossible — to lower your headcount through automation. Instead, a growing company shouldn’t need to add employees as rapidly as it would if it hadn’t automated its processes. That’s a critical competitive edge as you compete for talent. And, staff time moves from the tactical job of entering and verifying data to the strategic job of using that data to deliver better products and services. In other words, the ROI should be apparent early on, and break even on the investment should follow fast.

Operate from Anywhere

Of the practices that got businesses through 2020, “work from home” was paramount. For those employees able to function remotely, productivity turned out to be surprisingly high, and morale often flourished as work got done, and done well. Various business leaders have expressed a full range of opinions on whether and how the practice should continue, and CFOs likely have their own thoughts on the matter in light of the tangle of tax implications that come with a geographically dispersed workforce.

Still, workers whose jobs allow are clearly for either a work-from-anywhere policy or a flexible arrangement, with some days in the office and others at home. In 2021, a strict “back to the cube farm” stance may cost you talent.

Whether you can, and/or intend to, allow remote work once restrictions are fully lifted, it’s smart to at least retain the muscle memory because things happen: Pipes break, hiring accelerates faster than you can add space, blizzards close schools. Coping is easier with remote-work capabilities and protocols in place.

Because employees favor it and productivity seems to benefit, we advocate flexibility. First, talent doesn’t have a zip code. If you find a perfect marketer or data analyst in Montana, it’s worth considering a fully remote arrangement. That same worker in San Francisco or Boston is likely going to cost a lot more, and some highly talented people are longing for more open spaces.

- Adopt a cloud-centric policy for software systems: Assuming a hybrid or fully remote schedule works for your company, several actions taken in 2020 should now be made permanent. Primary among them is providing the tools workers need, preferably delivered from the cloud. Cloud providers live and die by the reliability and security of their products. Even the largest companies will be challenged to implement in-house versions of collaboration, productivity and core business systems that perform as well and reliably as cloud-based alternatives. Software delivered in an as-a-service model performs no matter where people are working and often costs less to boot.

- Rethink your real estate: There are savings to be gained by providing employees with the flexibility they First, losing the commute increases hours worked, surveys show. Flexible schedules also give employers the opportunity to rethink how they use office space, including whether they need as much as they have. But don’t limit your thinking to simply number of workstations or square footage. Tuning for collaboration without the need to give everyone a desk can be a game changer. For example, an emerging trend is tracking work output versus hours logged. In a recent survey, only 36% of employees at organizations with standard, 9-to-5, 40-hour workweeks were classified as high performers compared with 55% at companies that offer employees choice in when and where they work. Maybe some people want to come back more or less full time, while others want to drop in on an irregular schedule to sit in on meetings. As with software, when thinking about office design, focus on flexibility.

- Rethink core HR processes: All that sounds But some of you are thinking, “In the real world, there are challenges with remote workers, particularly new ones.” Getting them going on the technology kit is tricky, as is integrating new hires into the company and work team’s culture. That’s where HR comes in. Remote onboarding is its own discipline, all about bringing new employees up to speed so they’re productive, engaged and working toward company goals no matter where that work is done. This begins with the hiring process and continues with orientation, training and ongoing bi-directional feedback. Rethinking onboarding with a nod toward simplification and coworker mentoring will go a long way.

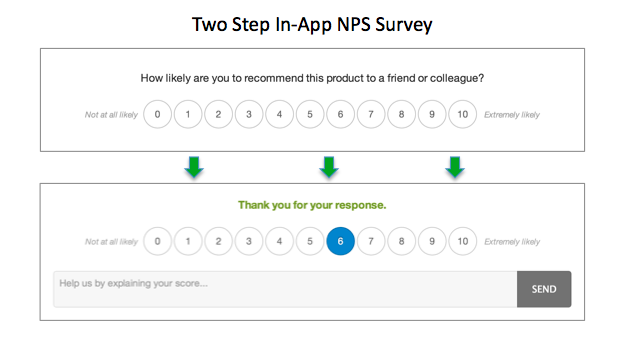

Metric-Driven Decisions

March 2020 demanded we make business decisions without much to back them up. There simply wasn’t data about how a once-in-a-century pandemic would impact global business and when to expect a recovery. Over in a few months? Years? Nobody could predict the extent of lockdowns. Hitting the brakes hard was a common first instinct, but for some it was an overreaction that left room for more daring competitors to take market share.

The sharp spike followed by a recovery in the unemployment rate is a good primary indicator of this overreaction.

Bottom line: There is a boom, but it’s a lumpy one, and if you expect workers to come back for less than $10 per hour, that’s probably not going to happen. On the other hand, consumer spending is also booming. Airports are packed. Many service-sector businesses simply can’t meet demand. If there was ever a time for careful data analysis, this is it.

But now, entering into what appears to be a V-shaped recovery, we do have data. Much of it is good, but not all of it. We’ve already talked about the worldwide supply chain issues that are likely to persist. Housing stock is below demand, building material prices are spiking, rental cars are impossible to get and summer gas shortages are predicted. Unemployment remains high even as companies are plagued by skills shortages. In March 2021, there were more unfilled job openings than during any month since we began recording that data more than 20 years ago.

Action Items

- Expand your data view: Analysis needs to consider internal and external data sources. If that hasn’t been part of your approach, this is a good time to fix that. It’s also a good time for B2B companies to reach out to customers to gauge their own business outlooks and expected demand for your goods and services. They’ll be eager to hear how confident you are in terms of fulfilling their orders. Most B2C companies are seeing the result of pent-up demand. However, goods from appliances to furniture are currently in short supply, and so are the parts to make them. So your analysis needs to broaden to include the economic forces at hand. Demand planning is a cross-functional, data-driven process that helps businesses meet their customers’ needs without overshooting on inventory.

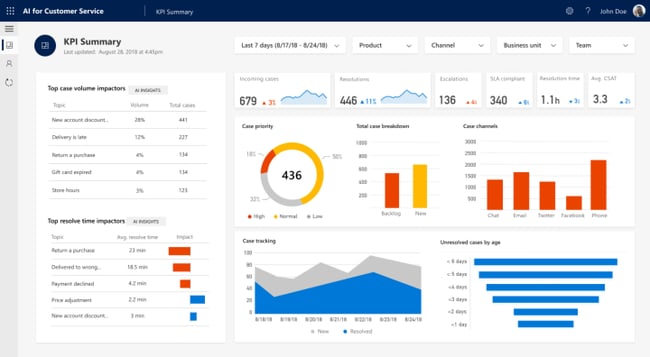

- Instrument your operations: Do you have systems in place to report on operations throughout the business, from sales engagements to marketing lead generation to raw materials costs? How about traditional finance metrics ranging from the big three — cash flow, revenue and profits — to more tactical but still highly important measures that provide insights on efficiency and progress? For instance, customer acquisition costs are rising for many sectors and, in some cases, threaten to substantially reduce margins. But CAC is only one factor in customer lifetime value, and only one of many critical financial metrics to track. Your challenges may be around rising supply or shipping costs, or higher wage demands. In the current red-hot market, choosing the right KPIs is more important than ever.

- Make financial analysis continuous: Whether or not your business had the right data to support scenario planning in 2020, most found a way to make plans for various contingencies. For finance teams, that often meant 55-hour-plus workweeks as they labored to understand cash flows, unit economics and other critical metrics that they’d never studied at the frequency or detail now required. Teams that had ERP systems in place, or that implemented them in 2020, have an automated way to gather data for ongoing financial analysis. As the volume and velocity of business increases in 2021, manual methods of analyzing data will be a strategic disadvantage.

Raising Capital

Is now the time to seek funding? A merger or acquisition target? Take your company public? There’s a lot of money out there looking for a home in a strong market. Many firms believe they could achieve growth, if they can just get some cash to seize the moment.

Attracting the attention of equity investors will require demonstrated growth and a clear path to profit for young companies — this was a loud trend heading into 2020, following a few years of perhaps irrational exuberance, and it’s here to stay.

If that sounds like you and your Rolodex doesn’t include many venture capitalists, get yourself to a pitch contest and make the case. Otherwise, consider other options.

Action Items

- Don’t count on bank loans, which are likely to be more scarce after post-relief funding: Last year saw the federal government loan or grant hundreds of billions of dollars to businesses in the form of Paycheck Protection Program (PPP) loans and Economic Injury Disaster Loans. Some of that continued in this year’s pandemic relief bill, including targeted funds for the businesses most impacted, like restaurants and entertainment venues. Some money is still out there, but prospects for future government stimulus remain uncertain. As loan and grant programs wind down, regular bank loans will pick up again. However, if trends continue, total loan pools will slowly shrink. In 2007, banks held $721 billion in loans of $1 million or less, according to The Wall Street Journal. In 2019, that was down to $680 billion. Meanwhile, bigger business loans more than doubled during that period to $2.82 trillion. So, while loans to smaller businesses aren’t unheard of, the underwriting standards are historically tight.

- If you’re angling for private equity funding, get your Rolodex out: Private equity is a path between conservative banks and high-growth-focused VCs. Last year as a group, PE funds raised over $200 billion, with much of it going to help stabilize companies that PEs already owned. Beyond that, tech/ IT deals grew by over 72%, according to PitchBook. Still, that’s only about one-third of PE investing — and an anemic number compared with the $2.9 trillion that’s sitting with PE companies uninvested.

- The M&A market looks promising, so be bold: If fast growth and/or diversification are on your agenda, a merger or acquisition may make sense in 2021. Private equity plays here too, backing over one-quarter of last year’s M&A activity in 2020. Particularly for established businesses that have solid customer bases but aren’t up for making the technology investments seen as critical for success in 2021 and beyond, selling to, or buying, a company with tech chops may be the best course. For many such deals, you just need a few lawyers, an idea of your valuation and an interested buyer. In some sectors, that may be a SPAC or PE firm, or more commonly, you may have a complementary business in mind to sell to or buy. If yours is one of the sectors that’s turning sharply up, creating a win/win scenario should be very possible. As with a valuation exercise, stress your assets: historically strong cash flow, a healthy profit margin, high customer lifetime value, low employee churn, bookings for the near future. Larger firms can position themselves for acquisition by increasing margins or adopting key technologies popular within their sectors, but unless that’s been a work in progress, it’s likely your books will do most of the talking. Finally, while there is VC money up for grabs right now, historically this has been a small, albeit extremely visible, niche within the financing market. Venture investments hit $125 billion in the first quarter of 2021. That’s up 50% from the previous quarter and a 94% jump from a year ago. Crunchbase details how this money is distributed. The lion’s share goes to late-stage companies — that is, those that already have ties to VCs. Most, though certainly not all, early-stage investment also goes to companies familiar to VCs. If you believe you have a shot, here’s how to get some attention. But there are plenty of other funding sources. If you’re outside the tech hubs where VCs roam, a different finance route may be more doable.

Want to know more?

Related Post

The Business Alignment Model: How to Make it Work for Your Company In 2023

In the early stages of a company, a common pitfall is a vague or ambiguous mission. A plethora of ideas, initiatives, and projects can pull

What Is Agile Finance? An Expert Guide

Today’s business environment is fast paced, hypercompetitive and constantly changing. It’s no place for the rearview-mirror finance and accounting processes of old. Instead, companies are

Mix equal parts SharePoint and Teams – A recipe for success

Collaboration tools are the utensils of the workplace. SharePoint and Teams, for example, each bring unique features to the table. One provides a central location

Bridging the Gap Between SharePoint and Teams

“I don’t remember where that file is.” “They said that all of the project details are in last week’s conversation. But which conversation?!” “There are