Why Do Companies Use Financial Projections?

A financial projection predicts a likely outcome based on one or more hypothetical assumptions. Those assumptions are the inputs of the financial model, which is a statistical tool used to predict what might happen as a result of different business decisions, market scenarios and more. With that information, the model can then show the expected financial position, operational results and cash flow.

Calculating several financial projections simultaneously in order to evaluate multiple scenarios and the possible responses is a common practice. Projections help a company better plan for risks, like a natural disaster that prevents it from getting a key part from a supplier or a sudden drop in demand after a competitor launches a superior product. They also help prepare for positive outcomes, like a spike in demand for a certain product or the increased capacity from opening a third warehouse. They give the business a much better idea of how external factors will impact its financials and the adjustments and investments it needs to make to achieve its goals.

Projections cover multiple financial metrics. Revenue projections can give investors and lenders a sense of how, for example, a 20% increase in sales could impact operating expenses on the income statement. Cash flow projections show where you will get that money—from receivables, loans, a line of credit or another source. A balance sheet projection can suggest the anticipated rate of return for someone who invests in your company.

Financial projections are useful for:

- Developing business plans. The financial section of a business plan should provide quarterly or even monthly projections for the first year and annual projections for the four years after These include projected income statements, balance sheets, cash flow statements and budgets for capital expenditures. The projections are important internally to determine everything from break-even points to growth plans, and to measure the company’s performance in its early years.

- Informing growth strategies and business management. Financial projections show discipline in financial management, and better financial management increases the chance of overall business success in a big way. By using a financial model to make projections, you can see if, when and whether your business will make a profit with its initial business model, what could happen if it added new products or services, when to hire new people to support the company, when to make capital investments and their potential payoff, and

- Due diligence for investors and lenders. The people and institutions investing and lending money will need to see proof that you can pay them back, and have a solid understanding of how you plan to do that. Some common benchmarks to project include how long it will take until the company turns a profit, sales in years three and five and data showing how your numbers compare to industry standards.

What Do You Need to Get Started?

Both financial forecasts and financial projections rely on current and historical transactional data, coupled with information on market conditions and industry trends.

Financial projections take the analysis a step further by applying a financial model to determine how certain variables will change the assumptions. Financial projections use information from current and past financial statements and external market information from government agencies, such as the U.S. Department of Labor, or market and industry projections from leading research and advisory firms.

Many finance leaders complete their first models in a spreadsheet program like Microsoft Excel, and the formulas allow you to model assumptions you’ve made. To build a financial model, you will ideally have at least three years of historical data, and the Journal of Accountancy provides a comprehensive list of financial data and metrics to include, such as:

- Revenue (including revenue levers, drivers, revenue driver activity assumptions and pricing)

- Cost of sales

- Selling, general and administrative (SG&A) expenses

- Capital investments

Oftentimes, the hardest part for startups and younger small businesses is getting these numbers in the first place.

Startups often run into the problem of trying to figure out what data to use for the foundation of their financial models since they have little to no sales history or metrics to work from. One source is industry and market research, like Standard and Poor’s (S&P) or Dun & Bradstreet, which provide national averages for businesses in different markets.

Newer companies can then pare down that information into the numbers most relevant to their organization. These figures can include the standard costs of revenue in every industry, the percentage of revenue attributed to the direct cost of sales or what percentage of revenue goes to overhead.

Another approach is to base calculations on the market share you want to capture in a certain time frame (top-down) or based on the resources at hand and the current data (bottom- up). Bottom-up forecasts are usually best for the shorter term (one to two years) and top-down for the longer term (three to five years). Used together, these two strategies offer a healthy balance between ambition and the reality of how much market share you can capture.

What Financial Models Should My Business Use?

Once you have these inputs, you can build and apply a financial model.

The three-statement model is the most important financial model and the one on which every other financial model is based.

True to its namesake, it takes the three core financial statements—income statement, balance sheet and cash flow statement—and uses assumptions and formulas to create a forecast for a given time period. The forecast starts with revenue and can also calculate expenses, debtors, creditors, fixed assets and more. Once the three-statement financial model is in place, employees can apply other financial models to conduct scenario planning and sensitivity analysis.

An employee building a financial model in a spreadsheet will create tabs for the income statement (showing revenue and expenses), balance sheet (detailing assets and liabilities), cash flow statement (money in versus money out), capital expenses and depreciation costs to establish a clear picture of the current financial health of its business. A finance professional then uses the assumptions as inputs and applies formulas to drive outputs that are projections. On the income statement, for example, assumptions can include revenue, average order value, refunds as a percentage of revenue, discounts as a percentage of revenue, cost of goods sold (COGS) as a percentage of revenue and operating expenses as a percentage of revenue.

Once the three-statement financial model is in place, other financial models can be applied to further understand the impact of various assumptions. These include:

- Sensitivity Analysis (What-If Analysis): A sensitivity analysis shows the effects of changes in assumptions such as selling price, supply chain costs, fixed costs, forecasted sales, delivery costs and other Sensitivity analysis models generally change one variable at a time and then demonstrate the impact of that change. For instance: How does changing the price of packaging or the advertising budget affect the forecast? Can the company boost profits if it changes the average selling price? For this reason, sensitivity analysis is also called what-if analysis. It challenges the person looking at the numbers to consider the reliability of the assumptions made. What happens if actual results turn out to be much different than expectations? Which factors have the biggest impact on the forecast or projections?

- Scenario Analysis: This financial model is closely related to sensitivity analysis but involves changing all or many variables at the same time, rather than one at a time. A scenario analysis looks at what happened in the past and what could happen in the future, including major changes that would have a lasting impact on the company. It typically includes base-case, worst-case and best-case scenarios. Scenario analysis could be used, for instance, to model the impact on total revenue of launching a direct-to-consumer channel, adding a new enterprise customer or, on the more challenging end, a natural disaster or the loss of a critical customer.

- Strategic Forecast Model: Businesses use a strategic forecast model to see how various initiatives they’re considering would affect long-term, strategic Also called long-range forecasting, this model helps organizations evaluate the impact of corporate projects, major finance initiatives and marketing and analysis plans on its long-term strategy. For example, a company may use the strategic forecast model to project the costs and potential revenue of opening a second manufacturing plant, building stores in another country or launching a new product line. It can then help leaders determine whether it’s in the business’s best interest to pursue those projects.

- Discounted Cash Flow Analysis: A dollar today is always worth more than a dollar two years from now. If you do nothing to your business and it makes a predictable amount of money each month, you know your cash flow. If you make an investment now—acquiring another company, for instance—that will produce new revenue streams in the future, that future money is not worth as much on a dollar- per-dollar basis as the money you’re spending right now. If you have a customer who is ready to sign a five-year contract to purchase a specific quantity of your product, that’s the basis for your new investment. As long as that customer has a strong business, you have a sure thing— you know the company will receive a certain amount of income for five years. You can use the interest rate on some other sure thing (like a five-year Treasury bill) to determine your discounted cash flow. If your estimated return on investments has historically been 90% of what you initially expected, then your discount rate needs to reflect that. In that way, your discount rate reflects both what you could earn if you just invested the money, plus a measure of risk based on market trends, your own history or both. You’ll use that discount rate to calculate the net present value of your investment, and if it’s positive, you’re making a good investment.

Calculating the net present value of investments is the best way to determine whether an investment is a good one or not. But the quality of calculation is highly dependent on your ability to set the right discount rate.

Step-by-Step Guide to Creating Financial Projections

While many finance departments rely on customized spreadsheets to do financial modeling and impact analysis for these models, there are several issues with this approach. Spreadsheets are challenging to manage, lack data transparency and integrity, do not integrate with operational plans, and are generally not efficient at handling financial modeling activities.

With planning and budgeting software, models don’t have to be created from scratch every time an executive asks for a projection. Cloud-based planning solutions enable users to create and compare multiple models that incorporate real- time financial and operational data. Since there’s less legwork required, the business can scale and apply this type of analysis to more business decisions, leading to faster insights for decision-makers. Despite those clear benefits, only 11% of small businesses surveyed by Robert Half said they have automated their financial modeling practices.

Small businesses just getting started with financial planning can create a basic model in Excel by following these steps below.

1. Create a new spreadsheet and label the first row “Assumptions.” Label columns B, C, and D with three future fiscal In these columns, you’ll make predictions about your performance in each of those years for a variety of metrics.

2. Label rows with revenue, units, price, COGS and operating expenses like marketing, labor or other categories of expenses that are relevant to your business.

3. Fill in the values with your assumptions, based on financial forecasts and your current financial Use a font color that is easily distinguished from black in the corresponding cells (like blue). Remember to format any dollar figures with the accounting number format by right- clicking the cells, going to “format cells” and selecting “accounting” in the “numbers” tab.

4. This is a good time to freeze panes. To do this, highlight cell B4 or its equivalent in your worksheet, go to “View” in the task bar, and click “Freeze panes.” This keeps your labels visible as you toggle around in the If you pay attention to the row numbers as we move on, you’ll see how this improves readability.

5. Next, move down a couple of rows to start calculating projections for your income statement, beginning with net The font for these values will be black. You will run the numbers in your assumptions through a formula to calculate net revenues by multiplying units by price (=B6*B7 in the sample from Figure 1). Copy and paste the formula to the next two cells to the right. The spreadsheet should automatically apply the formula appropriately for the year you’re working in, but it’s a good idea to make sure that it did by double-clicking the cell to view the formula. Ensure that the letters match the column for that cell. Make sure your number formatting is set to “accounting.”

6. Calculate COGS by multiplying units by unit cost (=B6*B10 in our example). Just as before, copy and paste that formula in the two cells to the right, checking to make sure it was applied appropriately for each column. Check your number formatting to ensure that it’s “accounting.”

Now, the format of your worksheet should resemble Figure 2.

7. Still within the income statement area, calculate gross profit by subtracting COGS from net revenue (=B18–B20 in our example). Copy and paste the formula to the next two cells to the Check the formulas and the number formatting for the correct column and “accounting.”

8. If you would like to see margins, you can divide the gross profit by revenue (=B22/B18 in Figure 3) and change the number format to percentage so you get the gross profit percentage.

9. While still within the income statement, calculate operating For our sample, this included labor and marketing in our assumptions—you may want to include additional costs—and we will reflect those same expenses in the income statement. Remember that you don’t want to enter the same value in two cells, so fill in these cells by using a formula to pull numbers from the source in the assumptions. In this example, we would compute labor for 2020 by entering =B13 because we got that number from the assumptions. That way, if we change the assumption later, the income statement will adjust along with it. Repeat this step for the remaining five cells in the operating expenses section of the income statement. Check your number formatting.

10. Calculate the total for operating expenses by adding all of the costs in this section together. In our case, we can simply add labor and marketing, but if you have more than two items here, you can use the sum formula. As always, check the number formatting.

11. Calculate operating income by subtracting operating expenses from gross profit (=B22–B28 in Figure 5, see next page). Copy and paste the formula in the cells to the Check your formula and number formatting.

12. Determine operating income margins by dividing operating income by revenue (=B30/B18 in Figure 5, see next page). Again, copy and paste the formula for the next two years, and check your formulas and change the number format to “Percentage.”

Now you have built a dynamic model using best practices that automatically calculates gross and operating margins as you change assumptions. While this is a basic model, it’s one of many that can help you set goals and make decisions for your company. It quickly gives you an idea of what your finances would look like based on projected revenue and expenses, and you could create multiple versions based on expected, high or low sales estimates.

Enabling Easier, Accurate Financial Projections With Software

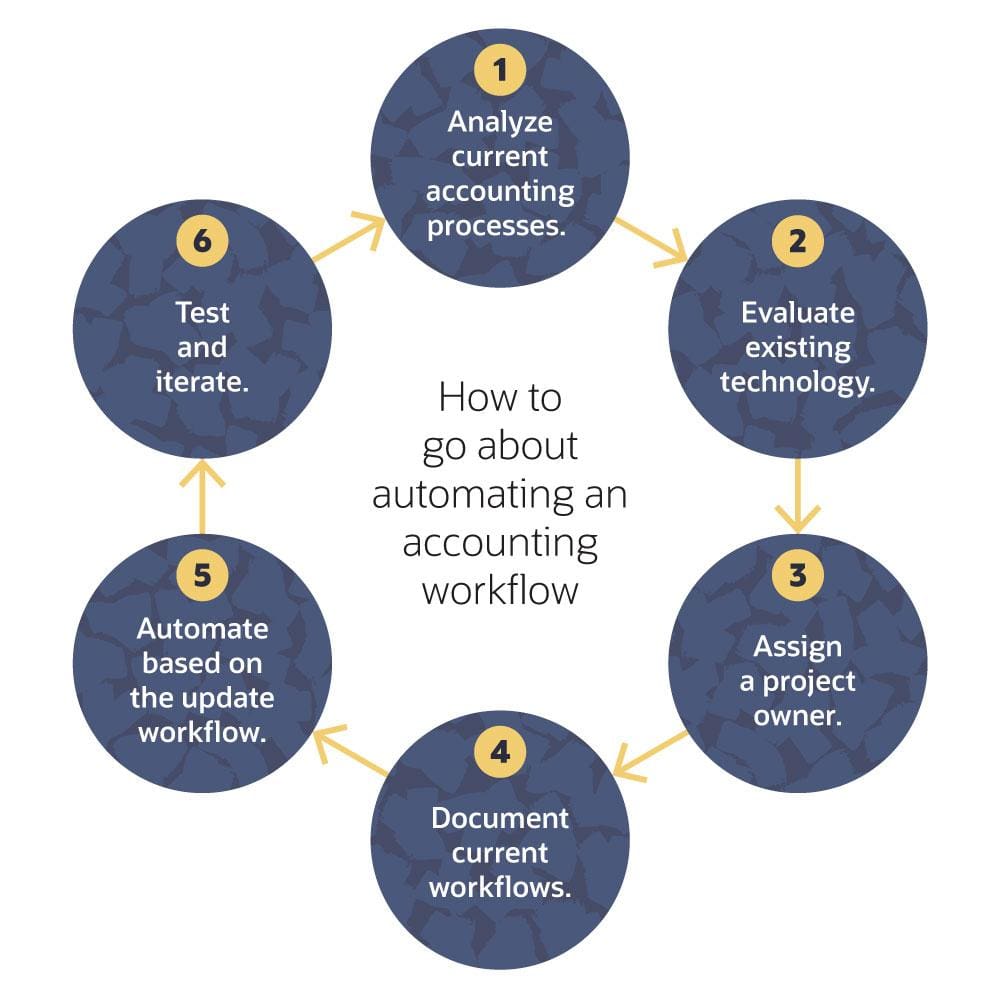

There are clear advantages to automating financial modeling capabilities with a planning and budgeting tool. Software can process more data and create visualizations to make projections easier to consume and glean information from.

The automation enabled by these systems means less time spent finding and entering data, and more time using the outputs of the model to inform and shape business decisions.

But any investment in automated financial modeling or manual calculations will be for naught without reliable, accurate inputs. That’s why it’s so important to start any journey to financial analysis by first automating as many accounting and finance processes as possible, since all other activities will use those numbers. As noted earlier, accurate financial statements are the baseline for solid financial analysis. In that sense, an ERP platform with robust financial planning capabilities like NetSuite often serves as the foundation for financial modeling and projections. Having a central database that updates in real time assures decision-makers that they’re using trustworthy numbers across all departments.

That single source of information helps financial planning and analysis teams overcome their chief challenge: data collection.

One survey found that the teams spend 75% of their time gathering and processing data. A system like NetSuite Planning and Budgeting eliminates that work by automatically pulling in historical data and applying it to pre-built, industry-specific statistical models that include revenue and expense modeling. That allows businesses to more accurately model what-if scenarios and predict potential results. NetSuite’s planning and budgeting application then generates a dashboard summarizing those predictions, and users can apply predicted values directly into their plan or forecast. Finally, the module eases the presentation of those results with drag-and-drop capabilities to build reports for different audiences and make it easier to share them with various stakeholders.

Financial models and projections have become increasingly crucial for finance teams. As companies become more aware of the various risks that could have a dramatic impact on their operations and revenue, they’re doing everything they can to plan for such events and avoid scrambling. Although financial modeling may sound daunting, anyone with a basic understanding of your finances should be able to perform basic projections. An ERP solution and planning and budgeting software will take your efforts to the next level and make more complicated and frequent projections feasible.

Eva

on

January 13, 2023