The three main ways a customer is drawn to a business is through marketing, sales, and customer service. In each of these, customers have different needs, goals, and expectations from your brand, but that doesn’t make one reason more important than another. These are all opportunities for your brand to acquire, convert, and delight your customers.

Let’s look at some examples of customer interactions, categorized by marketing, sales, and customer service.

Examples of Customer Interactions

Customer Interactions in Marketing

- A customer sees an advertisement for your brand on social media and comments on it.

- A customer sees store signage that details features of a specific product or service.

- A customer signs up for your email newsletter to receive weekly updates and promotions.

- A customer goes to one of your company events.

Customer Interactions in Sales

- A customer calls your support line and asks to speak with a sales representative.

- A customer is surfing your website and decides to open a live chat conversation with a sales representative.

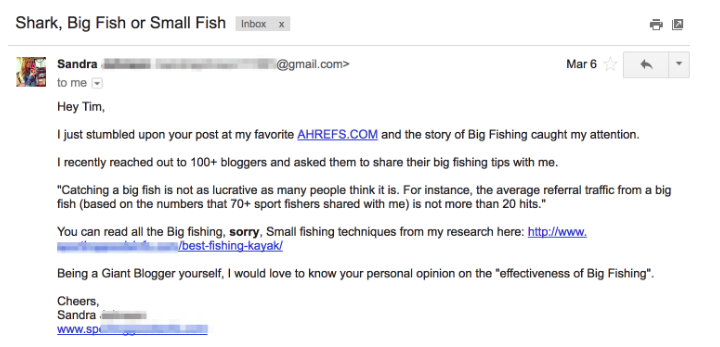

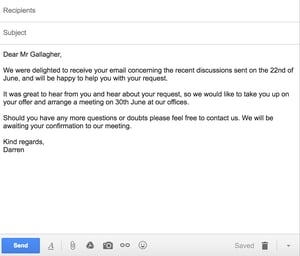

- A customer receives an email from your sales team and schedules a meeting.

- A sales representative calls a customer to see how they are liking their new product or service.

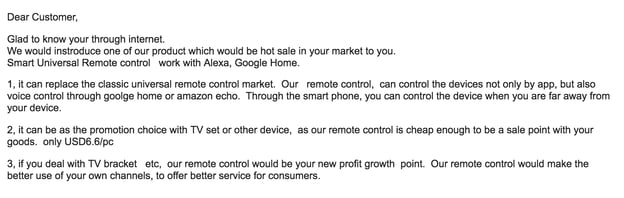

- A sales representative emails a customer to follow up on a conversation that had earlier.

Customer Interactions in Customer Service

- A customer calls a support line to get help with a product or service.

- A customer has a question about a product, service, or marketing promotion, and reaches out to your brand on social media.

- A customer who’s upset with their customer experience writes a negative review of your brand.

- A customer success manager reaches out to a customer who’s showing signs of churn.

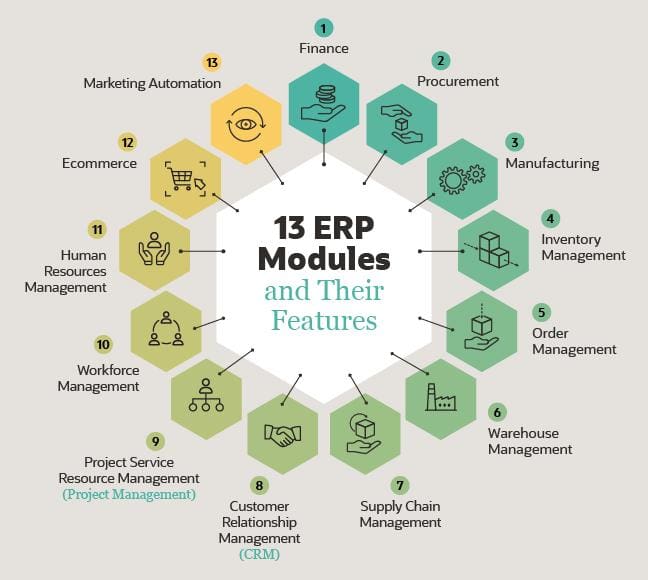

Across these functions of business, these various interactions are tracked in a single repository known as customer interaction management (CIM) software.

Customer Interaction Management (CIM)

This CIM software is used to manage and record interactions between an organization and its customers. From the beginning of a buyer’s journey to its completion, this type of software tracks all historical data from customers through a multitude of digital and in-person channels.

Customers interact with your business in many different ways, and CIM software can help you manage this communication across many of the following channels:

- Email

- Phone

- Live Chat

- Social Media

- Webpage

- Live Video

- In-Person

- Snail Mail

So we’ve discussed the different types of information tracked by customer interaction management, but why do we want to record this data in the first place?

Why is customer interaction important?

Customer interactions give businesses the data needed to improve customer satisfaction.

Without looking at customer interaction data, a business could be churning customers without knowing why. Reviewing that data can uncover gaps in communication, common occurrences that drive customers away, or other poor practices.

By taking the time to review the average customer interaction, your business can adjust its customer experience (CX) strategy to provide a more useful, pleasant shopping experience. And the more enjoyable the interactions become, the more likely customers are to become loyal to your business.

Now, let’s look at how you can make every customer interaction memorable with these handy tips.

How to Improve Customer Interaction Management

- Show empathy and gratitude.

- Be conscientious.

- Be transparent and communicative.

- Ask for and act on customer feedback.

- Surprise and delight your customers.

- Go where your customers are.

- Talk like a human.

- Give a gift that gains their loyalty.

1. Show empathy and gratitude.

Are you familiar with the golden rule? “Treat others as you want to be treated.”

The customer service golden rule should be “Treat customers as you want to be treated as a customer.” (I know it’s not as catchy, but I’m making a point here.)

We’ve written about the importance of empathy in a customer-facing role a few times before, and it deserves to be underscored again here.

It might sound simple, but making sure each and every one of your customer interactions demonstrate your empathy for your customers’ struggles, and your gratitude for their loyalty, goes a long way. Here are some ways to do that:

- Thank your customers — for everything. Thank them for their patience if your company experiences an outage or disruption in service. Thank them for understanding if you or your company makes an error. Thank them for their loyalty when they renew or buy again. Thank them for taking the time to share their feedback, whether it’s good or bad.

- Be empathic in your responses to customer complaints and issues. Say “I’m sorry” for whatever the issue is impacting in their day-to-day. The issue could be losing them time or money, or just causing a tremendous headache. You don’t always know what’s going on in your customers’ daily lives, so err on the side of apologetic if they come to you with an issue — great or small.

Customers are more likely to spend more and be loyal, longer, if they have a history of positive experiences with your company. Do your part to make each sign-off positive and gracious to make your customers feel good about working with you.

2. Be conscientious.

This is a lesson you may have learned when you were a student, or in your first job, and it’s important in your customer-facing job, too.

It’s of utmost importance to be conscientious and to responsibly follow-up to every customer communication you engage in with a solution, a forum for feedback, or helpful educational resources they can benefit from.

Whether you’re connecting with customers on the phones, via email, or by commenting on social media, your customers might think that reaching out won’t solve their problem (because — let’s face it — it can feel like that’s often the case when it comes to contacting customer service). Here are a few ways you can prove them wrong:

- If you can’t solve a customer’s problem with them in the first interaction, provide them with an exact and reasonable timeframe within which they can expect a resolution. Set a clear time and date, and put the responsibility on your plate to follow up.

- If your customer runs into an issue that you resolve, follow up with them a week or two later to make sure they aren’t still running into the same issue.

- Better yet, do research to investigate when your customers typically encounter issues with your product, and reach out proactively with educational communications to try to prevent that friction in the first place.

- If you’re in an ongoing relationship with a group of customers, take the time to learn more about them and their business, and reach out from time to time with information about their industry, or congratulations about a milestone.

3. Be transparent and communicative.

It’s extremely important to be transparent when you communicate with your customers — especially if it’s about a mistake or error caused by you or your product.

Using your empathy and gratitude muscles, don’t hesitate to explain the situation, apologize for the issue, and communicate how it happened — and how it won’t happen again. If it could happen again, be clear on that so your customer can prepare for the future.

Particularly if your product or service concerns customers’ personal data or information, or if your product serves as a system of record for a customer’s own business, you need to take your responsibility to your customers seriously. In today’s era of data breaches and credit card hacking, customers want to understand what you’re doing to fix problems and prevent them from happening again. Make sure you’re prepared with transparent customer communications during times like these — and if you’re not, ask your team manager or director for better guidance.

4. Ask for and act on customer feedback.

You can’t just give the term “valued customer” lip service — you need to walk the walk by regularly asking for and acting on customer feedback.

Regularly asking customers for feedback via surveys is an effective way to identify potential problems before they cause your customers to churn. Surveys also provide customers with an avenue to voice their thoughts on your product or your customer service in a way that makes them truly feel valued, and their specific feedback on 1:1 interactions with employees allows you to better hone your processes — or to shout out employees going above and beyond.

Your company may already have a process in place for regularly soliciting feedback, in which case you don’t want to inundate your customers with even more communications that could lead to survey fatigue.

If your company already has asking for feedback down pat, make sure you’re soliciting feedback in your 1:1 conversations with customers. Even if it’s not official or on the record, qualitative feedback will help you improve your service, and customers will appreciate the opportunity to be honest and share their views. And if your team isn’t already deploying post-call Net Promoter Score® surveys, it can be a helpful way to develop your skills and share learnings with the greater team.

5. Delight your customers whenever you can.

We’re big advocates of delighting your customers, and a big element of delight is the surprise element.

Make sure to take time periodically to surprise your customers. You don’t necessarily need to surprise them with a gift or a discount (although those can be nice). Sometimes, something as simple as a thank you letter, company swag, or a shoutout on social media can go a long way towards building goodwill and an emotional connection with your customers. And an emotional connection can sometimes be a bigger predictor of loyalty than responses to customer satisfaction surveys.

6. Go where your customers are.

As a customer, nothing annoys me more than when I send a Twitter DM to a company to complain about something, and they reply with a number I can call to voice my concerns. I’m already experiencing friction dealing with an issue with the product — I shouldn’t have to wait on hold to hear from a customer support rep, too.

It’s your job to make it as easy and painless as possible for your customers to get the answers they need to use your product or service. To do that, you should have a plan in place for providing service across a variety of channels where your customers typically reach out to you.

Strive to always respond to customer requests and issues on the same platform where they originally reached out. There are always exceptions to this — sometimes, you just have to talk out an issue or hop on a video call — but you should make every effort to keep communications on the same platform where your customer originally asked you for help. This helps you engage with customers faster to get them the answer they need.

7. Talk like a human.

Our final suggestion to make your customers love reaching out to you — even in cases of problems — is to talk like a human.

Your customers aren’t looking for scripted corporate-speak when they call or write to you in need of assistance. Particularly if you’re communicating with customers on social media, scripted, formal language can ring hollow and insincere.

If you’re in the middle of solving a customer issue, feel free to keep language professional. But once you’ve solved a customer’s problem, or if a customer is reaching out to share positive feedback, feel free to be less scripted, and more yourself.

Use good judgment to communicate with customers authentically in your own voice. For example, if customers are reaching out to you on Twitter, don’t be shy about responding back to them with a GIF or a hashtag. If you’re leaving them a comment on Instagram, try to work in an emoji. Little personal touches can endear you to your customers and make them more excited to connect with you.

8. Give a gift that gains their loyalty.

Thank you cards are great, but customers admire it when brands go the extra mile by sending them nice little gifts. Not only do gifts instill memories in customers, but they also add a special layer of happiness. So the next time you want to thank your customers, consider emailing them a gift card, grocery coupon, or a discount on your service/products.

Consider leveraging reward platforms for this, as they do all the heavy-lifting for your business. Xoxoday is a good option here — it’s cloud-based, robust, and lets you send gifts from your existing workflows instantly.

We are living in a world that’s highly competitive, and the way you deal with a customer leaves a big impact on your brand name. That’s why customer interaction must be done with extra care, as it serves as an incredible opportunity to grow your business.

While there are bad days and it is okay to make mistakes, it shouldn’t be the case often. With little planning and well-thought-out actions, you can pull this off right. The journey from customer interaction to customer loyalty isn’t overnight, but it isn’t complicated either. All it takes is the right loyalty rewards to appreciate them. Happy customers = Loyal customers! Let’s not forget that.

Make Your Customers Love Interacting with Your Business

The way your customers interact with your business will determine how you keep them engaged and coming back. We hope this article gave you a better understanding of how these interactions can be tracked, analyzed, and improved upon for happier, more satisfied customers to come.

Net Promoter, Net Promoter System, Net Promoter Score, NPS and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld and Satmetrix Systems, Inc.

Eva

on

August 31, 2022