Looking Beyond QuickBooks

Eva

on

September 9, 2022

- NetSuite

Looking Beyond QuickBooks

What’s Next? The Short Answer: ERP.

Even the smallest of businesses must balance its books and meet government compliance and regulatory financial reporting requirements. Early on, many small businesses turn to QuickBooks as an easy-to-use, affordable accounting solution. But there is more to your business than just debits and credits, paying bills and collecting cash. At the very minimum, you need to manage those operations that directly or indirectly generate your cash flow. In the beginning you might be able to control these operations with a series of spreadsheets, but sooner or later you will need more.

If your business is successful, eventually you will need to look beyond spreadsheets and QuickBooks. You will need a broader solution, something that helps rather than hinders your business. You might first try tacking on point solutions to address individual needs as they arise, but if these don’t talk to each other, before you know it, your “back office solution” is held together with the software equivalent of baling wire and duct tape.

So, what’s the alternative? The short answer is ERP. ERP is short for Enterprise Resource Planning, a convenient label for the software that runs your business. Yet many companies delay this next step, fearing implementation will take too long and be too costly. They also fear change and disruption.

While the perception that implementing ERP must be an expensive, scary ordeal lives on, research shows this is a myth that lingers from early days when ERP was rigid, limited in functionality, hard to implement and even harder to use. Today’s flexible, technology-enabled ERP solutions are nothing like those of the past. They provide many more features and functions, and are easier to implement and easier to use. And while ERP requires careful evaluation, selection, planning and commitment, it can indeed provide very significant returns on your investment.

Still not convinced? Read on to better understand how to recognize when the time is right for taking that next step, and what you can expect if indeed you do.

BUT FIRST… DEFINE ERP

Mint Jutras defines ERP as an integrated suite of modules that provides the operational and transactional system of record for your business. However most ERP solutions today do much more. And yet most small companies settle for something less, leaving them with little control and even less visibility into how best to grow most profitably.

Integrated is a key word in our definition and perhaps the biggest reason why, if you are small company, you can’t afford not to invest in ERP. You need most, if not all the key components required by large enterprises, and yet you don’t have the deep pockets to stitch different pieces of the puzzle together to make it a cohesive solution. And the alternative – manually transferring data between applications – is inefficient and error-prone.

Furthermore, while our definition represents the minimum requirements, most ERP solutions today can do much more. And yet many small companies settle for something less, leaving them with little control and even less visibility into the data needed for effective management and data-driven decision-making.

If you are running QuickBooks today, you essentially have a bookkeeping system. Yes, there are different versions of the solution, so you may have progressed beyond basic bookkeeping tools, adding on automated billing and/or tools to manage projects, inventory and contractors. But this still leaves a lot of the operations of your business underserved.

Today there are very affordable ERP offerings that not only support your accounting functions, but your operations as well, through a complete and integrated solution. And a lot of the old barriers preventing you from implementing a full solution, like lack of capital or lack of technical expertise, have been eliminated with the cloud, particularly those that are offered as software as a service (SaaS). A SaaS solution enables you to manage both your accounting and your operations without building out a data center, hiring a huge information technology (IT) staff or consuming a lot of capital.

Why… and When Do You Need ERP?

QuickBooks was designed with a small business in mind. While over time Intuit, its creator, has expanded its features and functions, and offers different versions of the product, even when you bought it, you probably knew (hoped) that you would eventually outgrow it. As you grow, you start to find areas that QuickBooks doesn’t handle, and perhaps your first response is to start filling gaps. But in doing so, you are also creating extra work and inefficiencies.

For example: Your sales team needs to manage contacts, opportunities and pipeline. So, you invest in a sales force automation tool, usually under the guise of customer relationship management (CRM). Now you have a customer master file in CRM, in addition to the one you use in QuickBooks. Are they the same? Synchronized? And, even though you might be able to create a quote in CRM or an estimate in QuickBooks, you still don’t have an order as part of your digital system of record. Do you still manage those in spreadsheets?

This is just one example of how data and processes can become clumsy and disjointed. How do you really manage your inventory, your warehouses, your workforce, your production? These are often the gaps QuickBooks leaves. If you start to solve these problems departmentally, applications can proliferate and pretty soon each department has its own version of the truth, and you start to lose sight of the forest for the trees.

Sometimes it is necessary to pull back and take a good hard look at the forest. Here are some “tell-tale” signs you need much more than a bookkeeping system, even if it is surrounded by other applications. These signs are all pointing you in the direction of a fully integrated ERP solution.

Redundant Data

You have multiple “master” files. Customers are stored in QuickBooks for invoicing, accounts receivable and cash collection. But they might also exist in CRM and in whatever application (or spreadsheet) that captures actual orders. You might have an item master defined in QuickBooks in order to value inventory assets, but is that the same item master that defines your product catalogue and drives warehouse operations and shipments? You might pay your employees through QuickBooks but where and how are skills inventoried and performance reviews managed? Is data scattered in file cabinets, offline spreadsheets and across applications? Can you guarantee all this redundant data is synchronized? Are you manually transferring it from QuickBooks to other applications? If you are, then you are almost certainly introducing errors and inconsistencies.

You’re Wasting Time

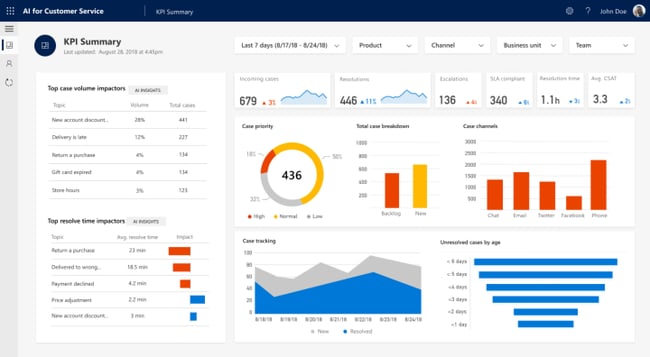

With scattered data, are you wasting time pulling together inconsistent and incomplete information? Do the various departments in your organization collaborate effectively to make data driven decisions or do they spend more time exchanging reports or waiting for data? And what happens when you can’t easily find the data? In addition to wasting time looking for it, are you wasting time working on the wrong tasks? Are you still performing manual tasks that could be easily automated? Even worse, are uninformed decisions misdirecting your efforts?

You Don’t Trust The Data You Do Have

When financial and operational data is not synchronized in real time you can get conflicting information. All it takes is one occurrence of this and people start to mistrust the data, causing them to second guess it, along with the decisions others are making. They wind up either wasting more time trying to reconcile it, or they ignore it completely, replacing it with their own data and observations, from what could be a very limited view. And yes, that means a proliferation of spreadsheets, which is another tell-tale sign that you need a complete and integrated solution. You need ERP.

You Can’t Meet Customer Demand

Your inventory levels are rising, yet you still can’t seem to meet customer requested ship dates. All the financial reporting and planning in the world won’t tell you how to meet demand. How do you better forecast demand, lean out your inventory, and produce product just-in-time when your financials and operational data are not integrated?

You Are Expanding Globally

It used to be that only large companies could establish a global presence. But the Internet has forever changed the world and leveled the playing field.

Today it is possible for even small companies to create a global brand, and this may mean you need to start operating as a multi-entity corporation. The 2019 Mint Jutras Enterprise Solution Study found even small companies (those with annual revenues below $25 million) operated from an average of 4.91 locations and 39% of them operate as a multi-national enterprise with multiple legal entities. This brings a new level of complexity to your business that can’t be managed from a desktop, or multiple desktops. Yes, there are online versions, but do they really go far enough?

Listen To The Signals, Reap The Rewards

These are just a few of the signals your business might be sending you, trying to tell you it is time to look beyond QuickBooks.

Switching from QuickBooks to an integrated suite of modules that forms the complete operational and transactional system of record – or in simpler terms, implementing ERP – can bring many benefits, not the least of which are:

- Eliminating manual data transfers across applications to speed processes and get everyone on the same page, in order to…

- Make informed, data-driven decisions from integrated financial and operational data

- Improve productivity and operational efficiency with a single integrated solution; putting that solution in the cloud brings added benefits

- Support growth and expansion, even when that includes multiple subsidiaries in multiple countries

In spite of all these potential benefits, many ignore the warning signs and delay looking beyond QuickBooks, fearing ERP. They assume implementation will take too long and be too costly. They also fear change and disruption. And while the perception that implementing ERP must be an expensive, scary ordeal lives on, it is indeed a myth. Today’s flexible, technology-enabled ERP solutions are nothing like those of the past. While ERP requires careful evaluation, selection, planning and commitment, it can indeed provide very significant returns on your investment, very often in a shorter period of time than you might imagine.

“Top 3” Goals of ERP

In our 2019 Enterprise Solution study, we asked participants to select their top 3 goals for implementing ERP. The most often selected were:

- 38% Support Growth

- 30% Improve customer responsiveness and fulfillment

- 30% Improve selected performance metrics

- 26% Gain more control and visibility

- 26% Gain a competitive advantage

- 26% Reduce frustration and improve efficiencies in transacting business

Debunking The Myths

In the past, ERP implementation admittedly was not for the faint of heart. Today however, it is neither the scary ordeal that it once was, nor is it doomed to fail. While past disasters provide good fodder for sensationalized headlines, failure rates are generally overstated. A recent Mint Jutras study of ERP implementation success found 67% rate their implementations as successful or very successful. Those who reported only partial success still realized benefits, although the results “could have been better.” However, those were most likely to be aging solutions with functionality limited by older technology. Even so, a scant 2% said they were “not very successful” and only one out of the 315 surveyed described their implementation as a failure.

Have A Plan – Set Goals – Experts Are Here To Help

That doesn’t mean it is a trivial task. Yes, ERP implementation is challenging and demanding, and potentially disruptive to your business during the project. You really must expect this. After all, it will be the software you will use to run your business – your whole business, not just the accounting functions. Unlike your implementation of QuickBooks, which primarily impacted your finance and accounting folks, ERP should involve all the different departments and functions in the organization. But the benefits are definitely worth it. So secure top management commitment and create a plan.

An ERP implementation is too important to embark upon without first setting goals. Goals are useful in setting expectations and driving return on investment (ROI). Our research shows goals are most likely centered around growth, improving performance and creating more efficiency.

Implementing ERP requires a different skill set than running your business. Don’t be afraid to seek guidance and assistance from those that do this for a living. ERP experts can help you identify goals, set a realistic schedule and budget and keep you on track. These experts will not be distracted by the day- to-day firefighting intrinsic to any business.

Setting A Good Pace

Your schedule should be aggressive enough to establish and maintain momentum throughout, but it must also be achievable. Putting together a schedule that is impossible to meet, regardless of how hard you work, adds additional stress on top of the stress introduced by any kind of change.

Typically the best people to involve in the project are those you can least afford to distract from their current responsibilities. But assign them anyway. Many, if not all members of the implementation team will still be required to do their “day jobs” during the implementation. These are the folks that will get it done.

So, what is aggressive enough, but still reasonable? The specific answer to that question will vary based on many factors, including the solution itself, the prior experience of the team, size of company, complexity of the business, and other factors. It is very important to work with your solution provider in this respect. Some, but not all, will have developed tools, templates and methodologies to speed implementation and improve your experience.

For decades, the “normal” implementation was thought to take nine to twelve months. But new, next generation software has been designed to be easier to implement and far easier to use and timeframes are shrinking. Our 2018 study showed the average time to a first “go live” was just over nine months (9.28) but our latest results from 2019 shaved about six weeks off that time for an average of 7.85 months. But even this reduction in time doesn’t tell the whole story.

First of all, we also saw a high rate of variability, and this variability was most dramatic in terms of expectations. Those with more aggressive plans achieved this milestone far ahead of those who allowed work to expand to fill the time allowed.

The important lesson here: While those who were most aggressive were a bit overly optimistic, they still managed to go live much faster than those who allocated more time. Don’t over-pad your schedule. Perhaps you can be overly aggressive, but it is better to err on the side of too fast than too slow.

Secondly, this year we found a few very long implementations skewed the overall average. Note that almost one in four (23%) achieved their first “go live” in less than three months and almost half (46%) did so within six months.

Expect & Achieve Results

A recent Mint Jutras report, The Real Facts About ERP Implementation, went into great detail in order to debunk the myth that ERP failure was more common than success. While limited to studying implementations in manufacturing and wholesale distribution, we find the overall results applicable to virtually any business today. Two thirds (67%) of those surveyed rated their ERP implementations as successful or very successful, and we found only one out of the 315 participants described it as a failure.

But the key question any small business has in moving from QuickBooks to ERP is, “How long will it take for it to pay dividends in terms of ROI?” In our surveys we specify ROI to be the length of time it takes to recoup 100% of the initial cost of ERP through cost savings or added revenue. We also ask for both the projected and actual time. While we have been observing both expectations and realized timelines shrinking for several years, we noticed a dramatic drop off between our 2018 ERP Implementation Study and our 2019 Enterprise Solution Study. For the first time ever we’re seeing both projected and actual time to be (significantly) less than two years.

We also find that company size is a contributing factor. While the overall average of the actual timeline for achieving ROI in 2019 was 1.63 years (about 19 months), if we look at the average for small companies only, the timespan is reduced to 1.33 years (about 16 months). But it increases steadily as the company grows. The sooner you recognize the need to look beyond QuickBooks, the faster you will realize the benefits. This actually makes a lot of sense, considering the complexity of the business typically grows along with revenues.

ROI is most likely to be directly attributed to cost savings, but can also come from increased revenue, especially when that increase comes without an offsetting and comparable cost increase. In moving from QuickBooks, the most obvious cost savings come from the operational side of the business. For product-centric businesses, that most often means a reduction in inventory, a result of having greater visibility and accuracy and better planning. But it can also come from better supplier management and even an increase in production capacity without adding headcount or capital investment (think machines and equipment), also through better planning and greater visibility than even the best financial reporting can ever provide.

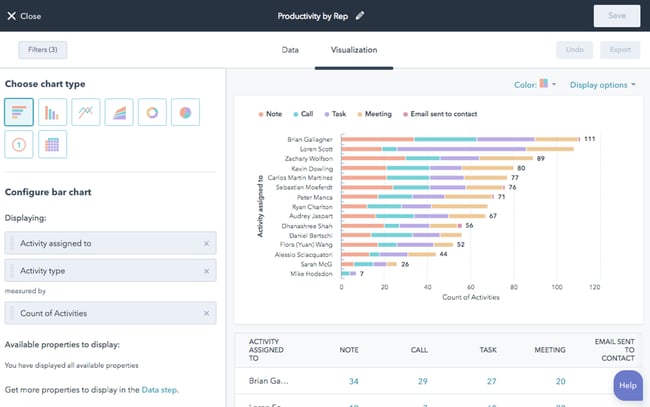

But in moving from a combination of QuickBooks and other tools like spreadsheets and individual point solutions to fill operational gaps, non-cost related improvements are perhaps even more important. Figure 4 provides you with a list of possible improvements and the likelihood of you experiencing them.

Summary & Recommendations

QuickBooks provides a great start for many small companies. It is an easy-to- use, affordable accounting solution. But there is more to your business than just debits and credits, paying bills and collecting cash. At the very minimum, you need to manage those operations that directly or indirectly generate your cash flow. In the beginning you might be able to control these operations with a series of spreadsheets, but sooner or later you will need more.

If you have started to fill those gaps with add-on point solutions, you have likely created an environment that is increasingly difficult to manage. If you have multiple copies of the same data (e.g. customers, products, employees, suppliers, etc.), are they fully synchronized? Are you manually transferring data between those applications or entering the same master file or transactional data in two or more systems? If so, you are almost certainly introducing errors. As soon as you find one of these errors, you begin to mistrust the data and potentially even start working around it, and also working around (not with) the applications that are intended to make you more efficient and more productive.

How do you get this less-than-ideal situation under control? The answer is in replacing your bookkeeping system, and those other individual, disconnected applications with an integrated suite of modules that forms the operational and transactional system of record. That’s the definition of ERP.

Yes, early ERP solutions were rigid and inflexible, limited in functionality, hard to implement and even harder to use. Today’s new ERP solutions are an entirely different animal. Solutions today can be more flexible and technology- enabled. They can provide many more features and functions to support, not just your finance department, but all your operational needs. They can be easier to install and with SaaS solutions, you even skip this step entirely. The best solutions are easier to implement and most importantly, easier to use.

As a growing company, you will outgrow QuickBooks. Plan your next step carefully. Evaluate solutions carefully. While technology has truly changed the ERP game, some vendors will have embraced this new technology more aggressively than others. It definitely pays to choose wisely.

Want to know more?

Related Post

The Business Alignment Model: How to Make it Work for Your Company In 2023

In the early stages of a company, a common pitfall is a vague or ambiguous mission. A plethora of ideas, initiatives, and projects can pull

What Is Agile Finance? An Expert Guide

Today’s business environment is fast paced, hypercompetitive and constantly changing. It’s no place for the rearview-mirror finance and accounting processes of old. Instead, companies are

Mix equal parts SharePoint and Teams – A recipe for success

Collaboration tools are the utensils of the workplace. SharePoint and Teams, for example, each bring unique features to the table. One provides a central location

Bridging the Gap Between SharePoint and Teams

“I don’t remember where that file is.” “They said that all of the project details are in last week’s conversation. But which conversation?!” “There are