How Business Intelligence Is Used in Accounting Today

Eva

on

August 16, 2022

- NetSuite

How Business Intelligence Is Used in Accounting Today

What Is Business Intelligence?

Business intelligence is a technology driven practice of analyzing data by developing key performance indicators (KPIs) and monitoring performance to inform decision making. BI provides historical, current and predictive views of business operations in easy to understand, interactive, data visualizations. Organizations use business intelligence software to analyze data and inform performance metrics, such as financial, sales, marketing or operations KPIs. With BI, companies can closely track financials, optimize their supply chains and make better decisions on everything from marketing to M&A.

BI functionality centers on built-in, customizable dashboards that allow for real-time reporting and analysis based on a central database. Decision-makers can identify exceptions, trends and opportunities and drill down into any underlying metric or transaction for greater detail.

Business intelligence systems allow the entire organization to make better decisions by analyzing very large volumes of data from all lines of business. Look for a scalable system that allows for mobile access from wherever people are working and that provides a range of connectors and integrations for you applications so you can pull in all the data needed to analyze the KPIs that your organization considers important.

Why Is Business Intelligence Vital in Accounting?

BI-enabled financial management software makes accounting professionals more productive and minimizes errors by automating data collection and analysis. Once CFOs determine what KPIs are important, BI keeps those metrics up to date and readily available in dashboards.

For example, a cash flow dashboard could show at a glance your current cash conversion cycle, quick and current ratios, days sales outstanding, accounts payable and accounts receivable turnover and other KPIs compared to historical periods. And the dashboard would provide continuous updates.

Accounting teams that aren’t manually compiling this data can spend time interpreting it and sharing insights with business colleagues.

Does Business Intelligence Relate to Accounting? How?

Efficient accounting is crucial for a business’s success, and business intelligence can help promote accounting success. Let’s look at an example of how we can draw a straight line from an accounting team’s use of BI to a business win.

If you are a retailer selling products and you’re out of a popular item, customers will click over to a competitor’s site, so having the right level of inventory is fundamental for retailers. Stockout rate is a KPI that helps with inventory analysis — it measures how often an item a customer orders is unavailable.

Take fictional sporting goods retailer VolleyTech. The start of spring soccer season brings demand for cleats, and VolleyTech merchandisers know that one British manufacturer’s footwear sells out quickly every year, leading to disappointed customers. They push to order extra pairs in the most popular sizes, but leadership balks.

Thinking about why the retailer didn’t want to order enough to avoid stockouts, one factor might be uncertainty about cash flow. VolleyTech has difficulty projecting revenue, so it chooses to run a tight, just-in-time ordering strategy that accepts some items being out of stock to save on costs, like storage, shipping and import fees. Plus, that manufacturer, U.K. FootballWear, knows its cleats are popular, so it can demand down payments on orders from smaller retailers like VolleyTech. That ties up funds that could be needed for operations or payroll.

With business intelligence, VolleyTech’s accountants can do in-depth cash flow analysis and forecasting. The team can take inputs, like expected operating and capital expenses, historical sales and stockout rate data, projected accounts receivables and payables balances, and even pull in external data sources, like long-term weather forecasts for prime cleat-buying months in locales where VolleyTech has stores. With that information, the company may find it can invest more in inventory. That keeps customers happy and may earn it a more favored partner status with U.K. FootballWear.

Can I Use BI Tactics in Accounting?

Using BI tactically in accounting will raise the team’s status as trusted strategic advisers, as the above example shows. Business intelligence tools also give accountants, including outsourced accounting professionals, the ability to quantify their own value within the company or for clients.

Think about the KPIs leaders use to evaluate the effectiveness of their accounting departments. For example, a good DSO, or days sales outstanding, ratio shows that accountants are effectively collecting the funds owed by customers. But dig deeper, and you’ll see that fast collections are based on effectively negotiating payment terms, and on the accounts receivable group tightly managing the credit extended to customers and collecting outstanding debts with few write-offs.

Business intelligence dashboards help accountants improve DSO ratios by, for example, setting up alerts to flag customers who are paying more slowly and thus may no longer be creditworthy.

BI means fewer errors and more complete documentation, which improves audit performance. It enables accountants to explain complex financial concepts to business users by generating easy-to-read charts and visualizations, and it lets accounting teams work leaner by automating manual tasks.

Tactical? Sure — but in sum, a strategic advantage.

How to Use BI to Influence and Improve Accounting

Successful use of BI to influence and improve the accounting function is all about how quickly an end user can access data and convert it into understanding or insight that allows for more accurate, timely decision-making that leads to increased profitability and business success.

When evaluating your program, ask: How are business intelligence capabilities actually being used? Do we have dashboards and data that further our accounting goals and the organization’s long-term vision and overall strategy?

Look also at these seven areas.

Improve insights

Business intelligence platforms allow accounting teams to pull together disparate data and communicate insights in a way that can deliver an “aha moment.”

Take our sporting goods retailer. BI-driven retail analysis might use purchasing behavior and retail trends data to show that younger soccer players are interested in competing year-round, and that indoor soccer leagues are springing up in a few northern states where VolleyTech operates. Cleats aren’t appropriate for indoors, so merchandisers might move quickly to source affordable shoes in sizes and designs suitable for the demographics most interested in year-round play. Using BI software to analyze inventory data will help VolleyTech create a purchasing and distribution process to get this stock into geographies with indoor facilities and leagues.

Improve accounting processes

BI improves accounting processes in obvious ways — aggregating data, creating dashboards more efficiently, improved planning and budgeting — and in less readily apparent areas.

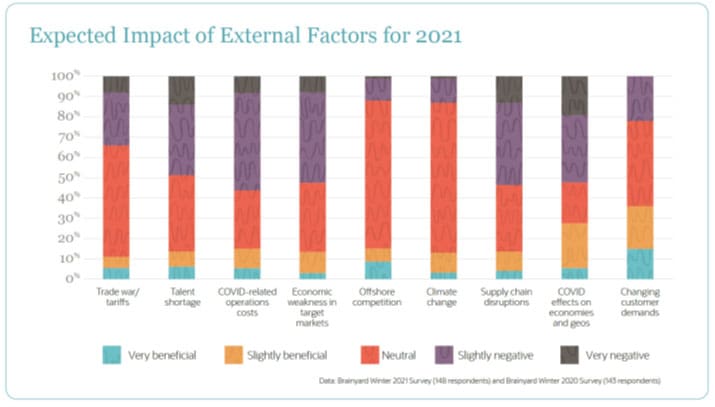

For example, the Brainyard survey showed that business leaders are concerned about the effects of supply chain disruptions, lingering effects of the pandemic and a shortage of talent.

Accounting teams that use BI in their processes can help address all of these:

- Better visibility into complex supply chains translates to fewer disruptions, and BI is all about visibility. For example, companies are considering onshoring and localizing their supply chains. This is expensive, though. How much more can you spend on raw materials and still be profitable? What effects do exchange rates and shipping have on costs?

- Accounting teams can pull in external data sources to improve forecasting and inform financial decisions as the economy recovers. For example, the U.S. government’s data.gov site offers free access to more than 218,000 data sets, including a number of COVID-19 data sets, many of which can be integrated with BI dashboards.

- Addressing a talent shortage is easier when companies can hire without worrying about proximity to a physical office. With BI tools, accounting can break down relevant data so that all departmental teams can work on their headcount budgets and collaborate remotely using a central database. This not only improves communication between accounting and hiring managers but also can improve the recruitment process.

Accounting data visualization

Accounting data visualization is the process of presenting financial information in a dynamic, graphical manner. Effective data visualizations help decision-makers consume a lot of sometimes complex information in a way that’s seen as intuitive and holistic.

There are obvious benefits to the ability to visualize data, including those “aha moment” insights we’ve discussed. But one upside that’s often overlooked is that, if you make data consumption enjoyable, decision-makers and relevant stakeholders will ask accounting to help them use dashboards more often. That may drive investments in new data sources and finance systems with built-in BI.

Improve productivity

One key payoff of the increased productivity benefits of business intelligence capabilities in accounting software is being able to scale without needing to add headcount.

First, the types and volume of data and requests for analysis and reports tend to grow along with the organization. With BI-capable accounting software, new data sources can be easily added to dashboards. And, accounting can set up customized dashboards and automatically generate analyses, minimizing manual effort.

And of course, business intelligence allows many finance processes to be automated. Let’s say it takes the accounting department days to prepare monthly financial reports when using traditional tools like spreadsheets. With BI-capable software, charts and graphs can be exported to reduce the amount of time needed to prepare financial reports.

Data-driven decision-making

Accounting professionals are natural-born data champions. Say a merchandise manager at VolleyTech has a gut feeling that customers would spend more for a line of fair-trade-certified soccer balls. Marketing agrees and believe that adding this line would be a sales opportunity.

How could accounting help quantify that hunch?

Tactics to apply data-driven decision-making to assumptions include applying inventory cost accounting metrics to the more expensive fair-trade balls, helping calculate cost-plus pricing to estimate a sales price point and comparing that to the highest-priced balls currently stocked. All these data points can help merchandisers determine if any new product makes sense financially.

Improved product and revenue analysis

With BI, finance can compile data from various sources into customized dashboards to allow for in-depth analysis that will yield ways to improve products and increase revenue.

For instance, let’s say business leaders need to figure out what’s behind a reduction in revenue. Digging into relevant data, they can identify any specific departments, offices or regions that are underperforming. Or, there may be other factors, such as new sales reps who may not have enough training to perform, or a product upgrade that temporarily drove down revenue.

One area to focus on might be total sales revenue.

Sales revenue is recognized on the income statement for the month in which the product or service was delivered or fulfilled, according to GAAP rules for revenue recognition. For example, say a VolleyTech location decides to offer in-person goalkeeping classes. It signs up 40 students in June, each paying $50 per session, and collected $2,500 in receipts. But it held only 20 of those sessions in June. It can recognize revenue for only those 20 students, making recognized sales revenue for June $1,250. The remaining $1,250 of sessions booked for July is recorded to deferred revenue. Given that, does it make sense to add another instructor to double the number of classes available in a given month? BI can help model adding another instructor a month to determine if it makes financial sense or not.

Improved KPI analysis

Key performance indicators, or KPIs, are metrics that are closely tied to strategic business objectives. Leaders should identify their key metrics early on and revisit that KPIs list periodically based on changes to the market, economic conditions or the business itself.

Once a list is established, companies need to agree on what numbers represent success — and signal rough times ahead.

For example, our U.K. cleat manufacturer might see fewer orders coming from EU countries as a result of Brexit. If its finance and accounting software had BI built-in, the company could have identified at-risk clients and worked with its FP&A (financial planning and analysis team) to run scenarios on how it could still meet its revenue goals, such as by offering a discount to increase its exports to U.S. distributors.

Business intelligence is the perfect complement to data-driven accounting professionals. It helps take the guesswork or opinions out of the decision-making process by providing real-time, factual results compared to business goals. When these results are shared across the company, decisions can be made faster. The accounting team not only becomes a trusted business partner but also has the information to improve business processes and performance.

A New Way of Doing Business

Cloud computing turns conventional software delivery on its head in a number of ways:

- Low overhead: Upgrades, maintenance and system administration take place in the cloud and are managed by the vendor, so you don’t have to spend nights or weekends supervising a new version upgrade or a failed server. One industry analyst study found that cloud-based business software cost 50% less than on-premise software over a four-year period for a 100-employee company

- Ease of access at anytime, and from anywhere: Cloud computing is “always on,” making it easy to grow your business and support remote workers and locations, or support a highly mobile sales or service team, because people can access the cloud any time, day or night, from any browser, desktop or mobile device around the globe, 24×7

- High availability: Cloud software architectures are designed from the ground up for maximum network performance, so they frequently deliver better application-level availability than conventional, on-premise solutions. For example, NetSuite commits to 99.5% availability for its customers, and provides data security such as PCI DSS compliance that would be cost prohibitive to achieve with on-premise software

- Security: For many companies, the level of security and availability, disaster recovery and back-up provided by a software-as-a-service provider far exceeds that which they can provide themselves. NetSuite, for example, provides data security such as PCI DSS compliance that would be cost prohibitive to achieve with on-premise software

- Fast deployment: You can be up and running with ERP, CRM or ecommerce applications, on a local or global scale, within a few months, rather than the six to 12 months it would take to install and troubleshoot conventional servers and software

- Optimized performance: The cloud adjusts to your performance needs, dynamically assigning server cycles whenever and wherever you need them, and automatically adjusting to spikes in your business.

- Subscription-based pricing: You pay as you go, often on an annual basis, unlike conventional systems where you have to make a major up-front investment in licenses, hardware and software. You benefit from better cash flow and far greater IT flexibility

- Energy savings: By eliminating the need for on-premise hardware, cloud computing reduces overall server room electric consumption as well, which can save a mid-size businesses more $10,000 or more per year, according to a recent sustainability impact study.

You’re in Control

Best of all, cloud computing lets you focus on your business rather than on your software. You don’t have to use valuable IT resources to keep business systems on life support. Instead, you can re-deploy them to focus on more strategic business initiatives while leaving your cloud computing vendor to worry about scalability, security, uptime, application maintenance and system upgrades.

And you can be confident in taking your business public, or into new regions of the world, without outgrowing your cloud computing resources, thanks to the world-class datacenters typically provided by cloud computing vendors.

Want to know more?

Related Post

The Business Alignment Model: How to Make it Work for Your Company In 2023

In the early stages of a company, a common pitfall is a vague or ambiguous mission. A plethora of ideas, initiatives, and projects can pull

What Is Agile Finance? An Expert Guide

Today’s business environment is fast paced, hypercompetitive and constantly changing. It’s no place for the rearview-mirror finance and accounting processes of old. Instead, companies are

Mix equal parts SharePoint and Teams – A recipe for success

Collaboration tools are the utensils of the workplace. SharePoint and Teams, for example, each bring unique features to the table. One provides a central location

Bridging the Gap Between SharePoint and Teams

“I don’t remember where that file is.” “They said that all of the project details are in last week’s conversation. But which conversation?!” “There are